How much do you know about behavioural biases?

Brush up on your biases

In this section you’ll be introduced to several behavioural biases and their meanings. Try to guess what you think it means based on the name, then click to reveal the description.

Choice overload

Choice overload occurs when we are overwhelmed by number of available choices. As a result, this can lead to inertia, where no choice is made. For example, a new investor may want to invest in a mutual fund, however, they may be faced with too many options. Overwhelmed by the number of choices, the potential investor may have difficulty choosing a mutual fund.Brush up on your biases

In this section you’ll be introduced to several behavioural biases and their meanings. Try to guess what you think it means based on the name, then click to reveal the description.

Mental accounting

Mental accounting is the tendency to mentally separate our money into different “accounts”. For example, if you have mental accounts for purchasing groceries, tuition, or vacations, but don’t use money from one “account” for items in another. This can lead to treating money as less interchangeable than it actually is.Brush up on your biases

In this section you’ll be introduced to several behavioural biases and their meanings. Try to guess what you think it means based on the name, then click to reveal the description.

Overconfidence bias

People are prone to being overconfident in their own abilities compared to actual reality, which can lead to higher levels of risk taking. For example, a driver who navigates to a new location may be overconfident in their navigation ability and not depend on a map.Brush up on your biases

In this section you’ll be introduced to several behavioural biases and their meanings. Try to guess what you think it means based on the name, then click to reveal the description.

Anchoring bias

Early information used as a reference point can irrationally influence later judgements. For example, if you first see a laptop that costs $5,000, and then see a second one that costs $2,000, you will likely see the second one as cheap. However, if you first see a laptop that costs $1,000, and then see a second one that costs $2,000, you will likely see the second one as expensive.Brush up on your biases

In this section you’ll be introduced to several behavioural biases and their meanings. Try to guess what you think it means based on the name, then click to reveal the description.

Sunk cost fallacy

Feeling committed to a situation because of how much you’ve already invested in it (time, money, effort), even if staying with it will lead to poor outcomes than not. For example, attending an outdoor event because you’ve already paid money for it, even though it is raining.Brush up on your biases

In this section you’ll be introduced to several behavioural biases and their meanings. Try to guess what you think it means based on the name, then click to reveal the description.

Loss aversion

This happens when people feel more pain from losses more strongly than the pleasure they feel from gains. It can lead to making decisions emotionally or placing more value on negative predictions than positive ones.Brush up on your biases

In this section you’ll be introduced to several behavioural biases and their meanings. Try to guess what you think it means based on the name, then click to reveal the description.

Disposition effect

The tendency among investors to sell stock market winners too soon and hold on to losers too long.Brush up on your biases

In this section you’ll be introduced to several behavioural biases and their meanings. Try to guess what you think it means based on the name, then click to reveal the description.

Status quo bias

We tend to stick to what we know and choose the default choice because of the familiarity and new choices feel risky. For example, a new employee is more likely to enroll in health insurance if being enrolled is the default and opting out is a choice.Match them up

You’ve learned the names of several behavioral biases and their meanings. Now, let’s see if you can match the names to their meanings.

Fill in the blanks by dragging the answer or clicking the arrow button in each answer box to select the right match.

Terms

Bias Detective

Now’s your chance to use what you’ve learned and be a detective. In this final section you’ll be shown examples of everyday situations where a behavioural bias (or more than one) may affect the decision-making process.

Review each scenario and pick how you would respond based on the three choices provided.

There may be other possible ways to respond that are not shown but choose the closet match for yourself.

There is no wrong answer. Remember, we are all prone to behavioural biases. This tool will help you become more aware of your biases and offer tips on how to manage them when making financial decisions.

Scenario 1

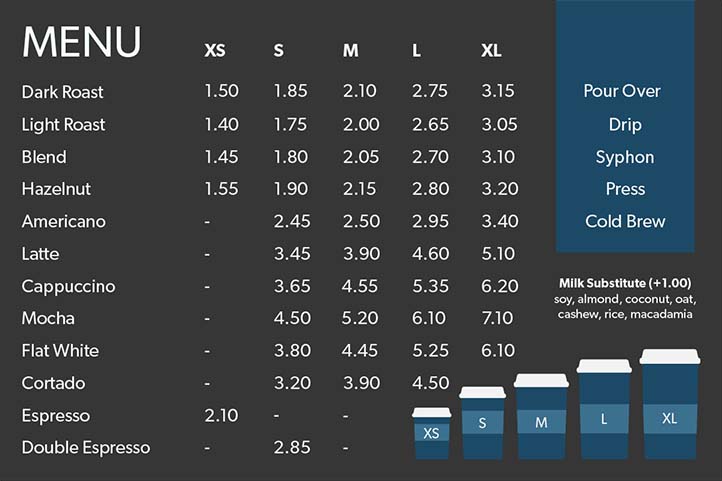

You’re waiting in line at a café that’s new to you. The menu is large, and by the time you get to the cashier you still haven’t been able to read all of the choices. Are you more likely to (select the choice that fits best):

Tip:

Bias Detective

Now’s your chance to use what you’ve learned and be a detective. In this final section you’ll be shown examples of everyday situations where a behavioural bias (or more than one) may affect the decision-making process.

Review each scenario and pick how you would respond based on the three choices provided.

There may be other possible ways to respond that are not shown but choose the closet match for yourself.

There is no wrong answer. Remember, we are all prone to behavioural biases. This tool will help you become more aware of your biases and offer tips on how to manage them when making financial decisions.

Scenario 2

You meet with your financial advisor to review your portfolio. You discover that an investment you’ve held for a few years has continued to decline. How would you respond in this situation (select the choice that fits best)?

Tip:

Bias Detective

Now’s your chance to use what you’ve learned and be a detective. In this final section you’ll be shown examples of everyday situations where a behavioural bias (or more than one) may affect the decision-making process.

Review each scenario and pick how you would respond based on the three choices provided.

There may be other possible ways to respond that are not shown but choose the closet match for yourself.

There is no wrong answer. Remember, we are all prone to behavioural biases. This tool will help you become more aware of your biases and offer tips on how to manage them when making financial decisions.

Scenario 3

You’ve spent the last 2 years saving for your dream vacation. Congratulations! You’ve followed a budget and by the end of your fun-filled vacation week you discover your budget still has $200 left over. Your friend gives you some suggestions for several different vacation activities you could spend it on, ranging from an extra outdoor adventure day trip to a room upgrade for your last night there.

Tip:

Bias Detective

Now’s your chance to use what you’ve learned and be a detective. In this final section you’ll be shown examples of everyday situations where a behavioural bias (or more than one) may affect the decision-making process.

Review each scenario and pick how you would respond based on the three choices provided.

There may be other possible ways to respond that are not shown but choose the closet match for yourself.

There is no wrong answer. Remember, we are all prone to behavioural biases. This tool will help you become more aware of your biases and offer tips on how to manage them when making financial decisions.

Scenario 4

A year ago, the stock GSAM that was priced at $50/share. Today, the share price is $100/share. You have been watching GSAM periodically over the last year, so you think you know GSAM well. However, there is also news from credible sources that indicate GSAM has more room to grow. You have some capital to invest.

Tip:

What’s the next step?

Congratulations! You’ve completed all activities.

We hope this tool has helped raise your awareness of how your financial decisions can be influenced by behavioural biases.

Tips based on your selections

Additional Take Action Checklists

Manage choice overload:

- Narrow your choices in advance. For example, giving yourself a spending limit. At the café, would you have made a different beverage choice if you could only spend $3?

- Remember your goals. If you’re choosing between investments, remind yourself of the time horizon you’re working with and whether that narrow your choices.

- Allow yourself time to choose. Set aside time in your calendar to meet with an advisor or do the research you need to do.

Make mental accounting work for you:

- Review your budget on a recurring basis. Make sure the plans you have for your money are still the right ones. If you don’t need the same takeout budget you’ve had for the last year, put that money towards something else.

- Remember that money is fluid. It can be spent, saved, earned, invested, in many different ways.

Counter over-confidence bias:

- Get a second (or third) opinion. Be open to others’ opinions and try not to be entrenched in your own.

- Look at your past. Visualize some of the investment decisions you’ve made on your own and consider how well or poorly they worked out.

Counter loss aversion or sunk cost fallacy:

- Compare potential losses and gains. Re-frame the decision to compare what you could lose or what you could gain. This will help you to consider other alternatives.

- Diversify your portfolio.

Manage anchoring bias:

- Being aware that you are prone to this kind of bias can help you avoid it.

- Consider alternative choices when making decisions, for example if you would make a different choice if you relied on different information.

Manage status quo bias:

- Weigh the pros and cons of the decision. Critical thinking can often help you consider alternatives and make an informed decision in the end.

- Check your motivations. Will your decision help you reach your goals, or is it simply the easiest choice to make right now?

- Set immediately, attainable goals.