This report, prepared by the Investor Office of the Ontario Securities Commission, sheds light on financial consumers’ views on and understanding of crypto assets (commonly referred to as “cryptocurrencies”), as well as the attitudes and behaviours of crypto asset owners.

On this page you’ll find

Read our full report, Taking Caution: Financial Consumers and the Cryptoasset Sector.

Crypto assets are designed to serve a variety of purposes. They may be used as, among other things, a store of value, a medium of exchange, or a right that lets you access a product or service. Crypto assets primarily designed to be a store of value or medium of exchange (e.g., Bitcoin) are often referred to as “digital coins.” The term “digital tokens” commonly refers to crypto assets created by a business, often to raise capital and often to allow users to access a service that the business plans to provide in the future.

The vast majority of Ontarians are approaching crypto assets with caution. Only a small percentage own crypto assets, and that those who do own crypto assets tend not to spend substantial sums of money acquiring them.

However, Ontario’s large population means that even small percentages can translate into substantial numbers — numbers sufficient to concern the OSC as a securities regulatory authority.

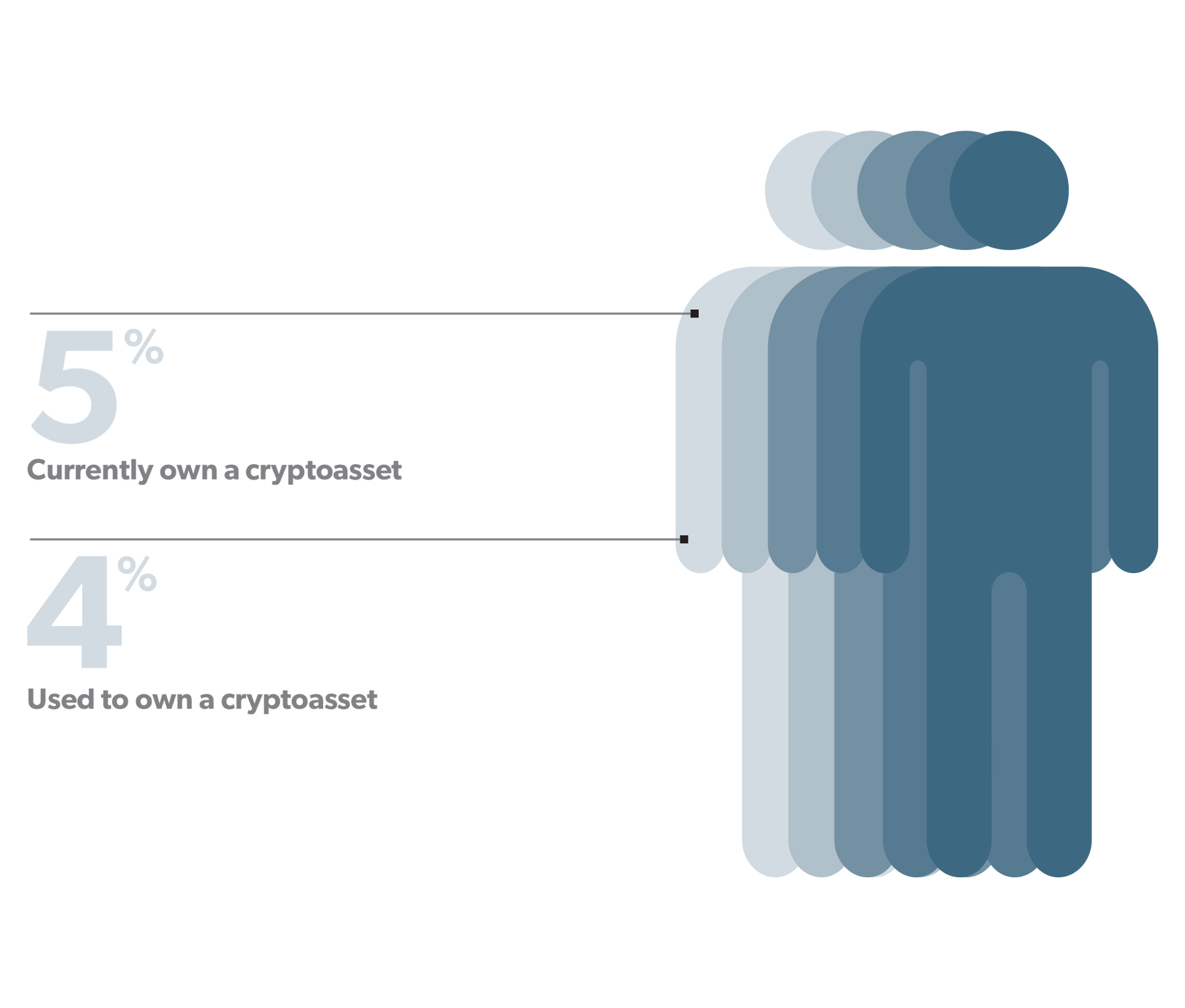

Five percent of Ontarians currently own cryptoassets

Based on recent population estimatesi, this figure translates into over 500,000 Ontarians currently holding at least some crypto assets. An additional 4 per cent of Ontarians owned crypto assets in the past but no longer do.

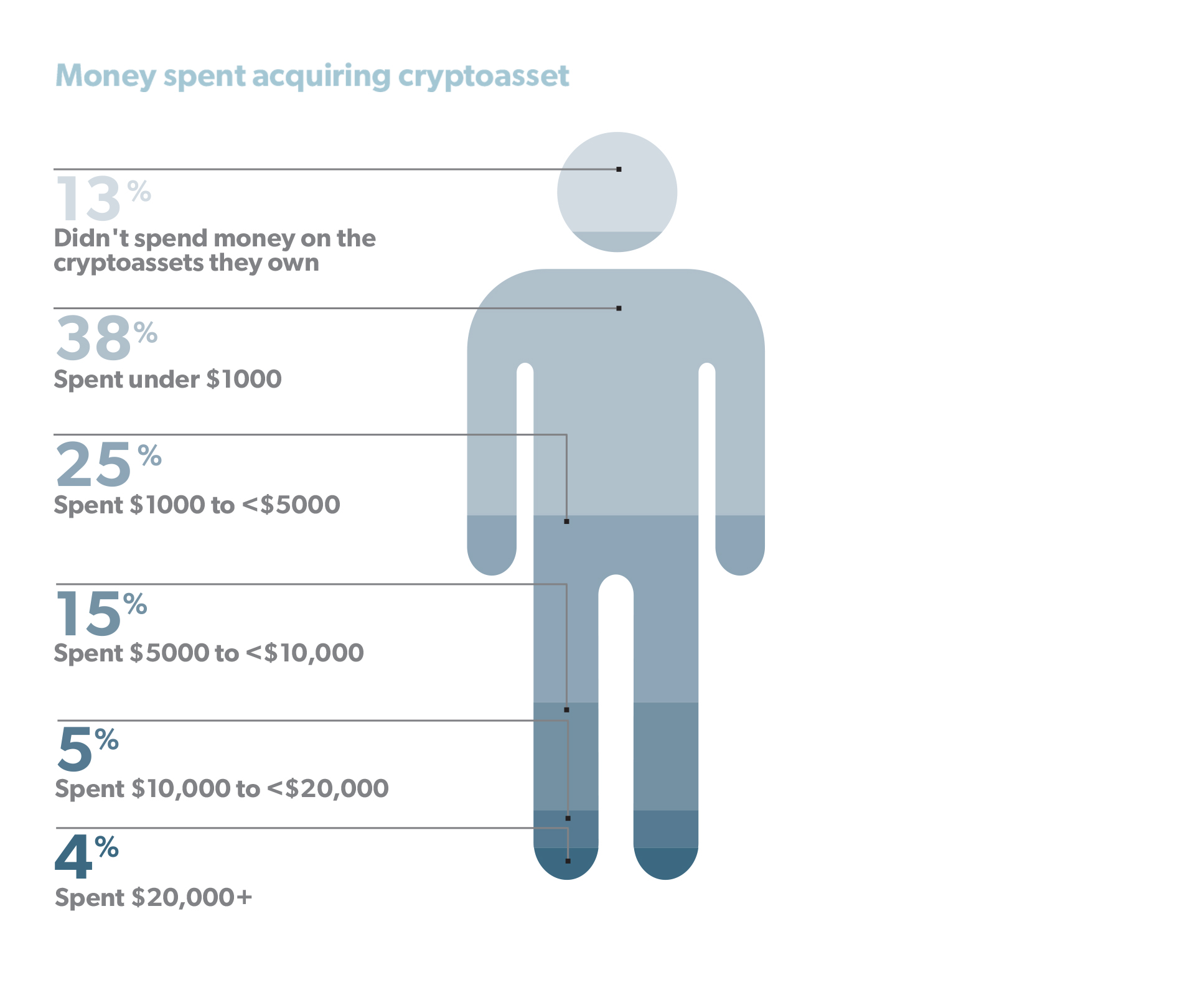

Half of cryptoasset owners spent under $1,000 on their cryptoassets

For the most part, crypto asset owners have not spent substantial amounts of money acquiring the crypto assets they own, with half spending under $1,000, and 90 per cent spending under $10,000. However, 9 per cent of crypto asset owners—translating to about 50,000 Ontarians—reported spending $10,000 or more acquiring crypto assets.

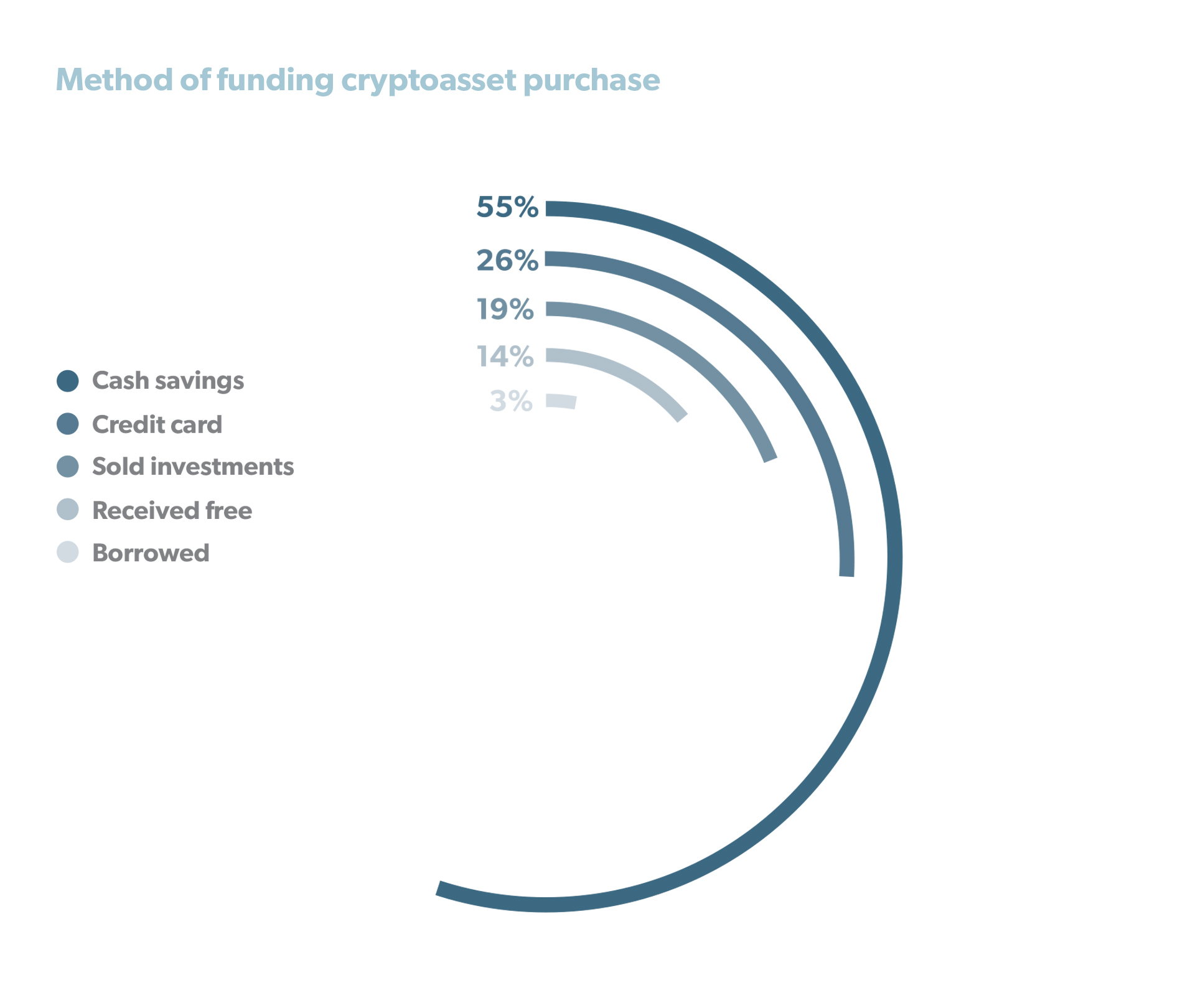

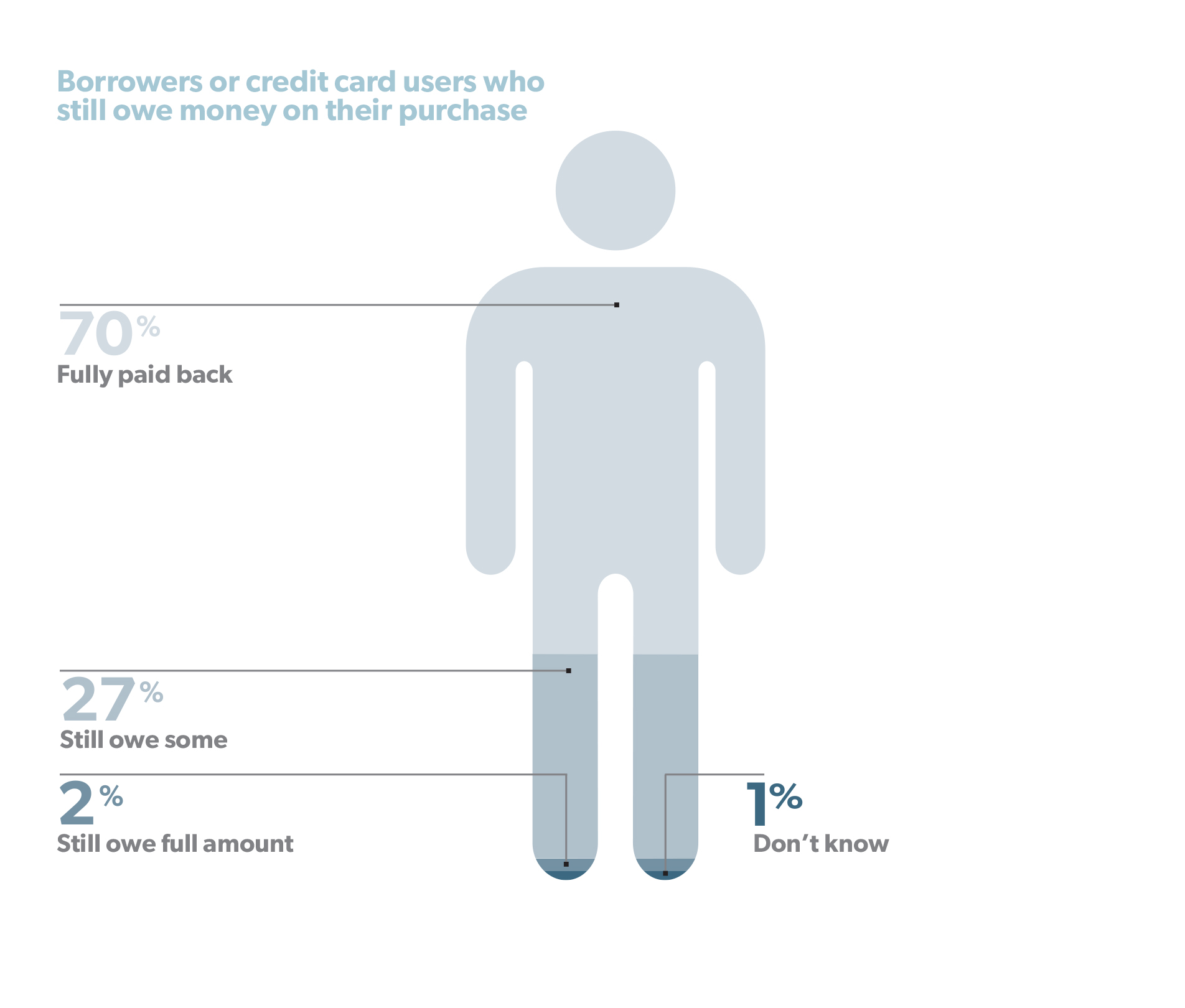

Most past and present crypto asset owners used cash savings to purchase crypto assets. Of those who used a credit card or otherwise borrowed money, more than 2 in 3 have paid back the money they borrowed in full.

Cryptoasset buyers aren’t sure where to go with a complaint or who regulates ICOs

When given a list of organizations and asked which organization they would go to with a complaint, 30 per cent of past and present crypto asset owners said they wouldn’t know where they would go for help, and others split evenly between the various organizations listed. This may indicate that, to the extent crypto asset users have complaints about their experiences with different crypto asset service providers, these complaints may be diffused among different agencies.

In addition, when asked who they believe regulates ICOs, half of past and present cryptoasset owners responded either that they don’t know who regulates ICOs or that they believe ICOs are not subject to regulation.

This belief is incorrect. Most ICOs are subject to securities regulation. Securities regulatory authorities recently released new regulatory guidance for businesses considering launching ICOs, discussed in the report.

The OSC and other securities regulatory authorities have emphasized the significant risks associated with crypto assets, and the Investor Office has developed several educational resources in our Cryptocurrencies hub on the characteristics and risks of different types of crypto assets. The OSC will continue to monitor this sector as it develops and act to protect investors while also fostering innovation in the capital markets.

Read our full report, Taking Caution: Financial Consumers and the Cryptoasset Sector.

_______________________

i The adult population of Ontario was 11,490,799 as of July 2017. Statistics Canada, Table 17-10-0005-01, Population estimates on July 1st, by age and sex (13 June 2018), https://bit.ly/2afMALX.