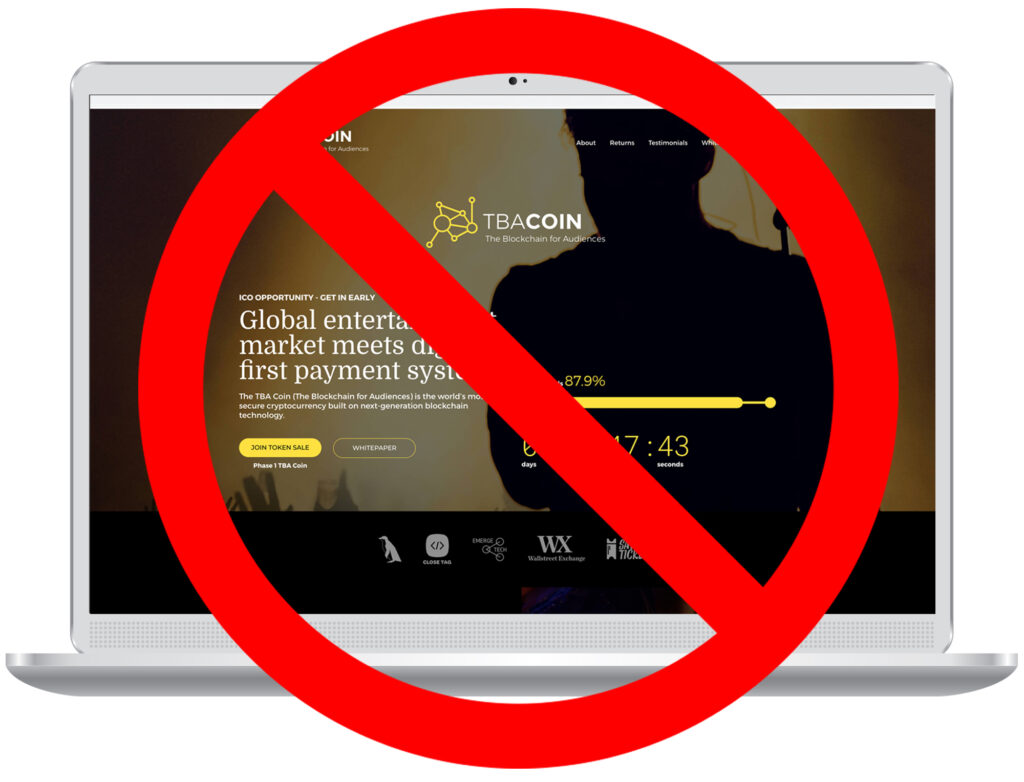

TBACoin is not real. TBACoin.ca was created to raise awareness about fraudsters pretending to be involved in cryptoassets and blockchain technology.

Initial coin offerings (ICOs) (often referred to as initial token offerings (ITOs) or token generation events) are an innovative means for businesses to raise capital. Over the past several months, many Ontarians have been approached about or participated in an ICO.

Unfortunately, many fraudsters have tried to take advantage of this trend by branding old-style investment scams as fake ICOs. These fraudsters typically set up flashy websites and try to generate hype through ads, social media and other channels.

You can better protect yourself and distinguish a legitimate ICO from a fake offering by knowing how to recognize the red flags of fraud.

4 signs of investment fraud to look for

1. You can make a lot of money with little or no risk

In general, higher-risk investments offer higher potential returns, and lower-risk investments offer lower returns. This is known as the risk-return relationship. When you buy investments like stocks, there’s no guarantee you’ll make money. And the risk of losing money increases with the potential return. Investments that are considered low risk typically have returns similar to GIC rates. If your expected return is higher than this, you’re taking more risk with your money. Learn more about the risks of investing.

2. You get a hot tip or insider information

The sources of “hot tips” or “insider information” don’t have your best interests in mind. Think about why they’re offering you tips, and how they benefit by telling you about them. If the hot tip is false, you will lose your money if you act on it. If it is really inside information about a public company, it would be illegal to act on it under insider trading laws.

3. You feel pressured to buy

Scammers frequently use high-pressure sales tactics – because they want to get your money and then move on to other victims. If you’re asked to make a decision right away, or are presented with a limited time offer, it’s likely not in your best interests. Scammers know that if you have time to check things out, you may not fall for their scam.

4. They’re not registered to sell investments

Before you invest, check the registration and background of the person offering you the investment. In general, anyone selling securities or offering investment advice must be registered with their provincial securities regulator.

- Check registration through the Canadian Securities Administrators’ (CSA) National Registration Search.

- Check their background to find out if they have been in trouble with a securities regulator using the CSA’s Disciplined Persons List.

The Ontario Securities Commission (OSC) recognizes blockchain’s potential to foster innovative ways of raising capital and increase transparencies and efficiencies in the capital market.

The OSC is working to encourage innovation through OSC LaunchPad, which engages with fintech companies to help them navigate legal requirements and strives to keep regulation in step with digital innovation.

The OSC has also prepared a number of resources to help investors learn more about cryptoassets. You’ll find a number of resources on GetSmarterAboutMoney.ca, the OSC’s investor education website, which provides unbiased information about investing and tools to help you make informed investment decisions.

Learn more about how cryptoassets work, the key features of different cryptoasset products, and how to distinguish a legitimate cryptoasset offering from a fraud.