Non-viability contingent capital securities are subordinated debt and preferred shares issued by banks that can be converted into common stock if a trigger event occurs. These types of securities offer higher yields, but have their own unique risk and suitability factors that investors should consider carefully.

On this page you’ll find

Non-viability contingent capital securities explained

Non-viability contingent capital (NVCC) subordinated debt and preferred shares are products that offer higher yields than government bonds and most high-quality corporate bonds, but also have unique risks.

NVCC securities are hybrid financial securities that have elements of both debt and equity, but are fundamentally different due to a mechanism that allows them to be converted into common stock. This conversion has two potential trigger events:

- a bank is facing financial difficulties so severe that it is deemed “non-viable” by the Office of the Superintendent of Financial Institutions (OSFI); or

- a government injection of capital or similar support has been provided or agreed to, without which the bank would be non-viable.

Conversion of NVCC securities is based on a trigger event occuring. If a trigger event happens, then NVCC securities are permanently converted into common stock in order to provide the bank with the capital necessary to meet its financial obligations and continue operating.

It is also possible that a bank may fail directly, without invoking a conversion of NVCC securities.

Investors should be aware that certain series of subordinated debt or preferred shares may be of the NVCC variety, while other series may not contain NVCC features, even when issued by the same bank.

Why NVCCs were created

In response to the 2008 financial crisis, the international committee on banking oversight set new standards, such as new and higher capital requirements, to make banking systems more resilient in the event of future financial or economic downturn.

As a result, OSFI instituted new rules that require banks to have additional equity readily accessible to help withstand major financial stress and to transfer more of these capital risks from taxpayers to holders of these securities.

2 types of NVCC securities

- NVCC subordinated debt. Subordinated debt securities provide a contractual interest rate and rank below senior and certain other types of debt securities, meaning that if a company fails, its subordinated debt will only be repaid after all other higher ranking debts and loans have been settled.

- NVCC preferred shares. Preferred shares rank below subordinated debt in terms of their claim on a company’s assets. They provide investors with regular income through dividends that must be declared and paid in priority to dividends on common shares of the issuer.

4 risks of NVCCs

- Lower credit ratings. Because of their hybrid structure, NVCCs have lower credit ratings than otherwise identical preferred or subordinated securities that do not have a risk of equity conversion.

- Limited trading history. NVCCs have only been issued since 2014, meaning they have a short trading history to examine. Their performance during sustained adverse markets or extraordinary events has not been tested.

- Potential loss of value upon conversion. If a bank is required to convert the NVCC securities it has issued, investors may find themselves owning common stock that has a much lower value than the subordinated debt or preferred shares that they originally purchased. Conversion formulas are based on events at or near the time of conversion, meaning investors won’t know with certainty the value of shares that they would receive.

- Unexpected assets. In the event of an NVCC conversion, investors would have common stock that may not have been a part of their intended portfolio holdings.

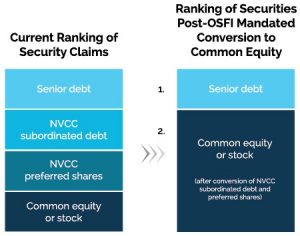

The diagram below illustrates how creditor rankings change when an extraordinary event leads OSFI to declare that NVCC subordinated debt and preferred shares securities of an issuer be converted to common stock.

Please note that the diagram does not represent the dollar amounts before or after a conversion, nor does it illustrate the respective shares or percentage shares of these securities in a bank’s capital before or after a conversion.

Key point

NVCCs have distinct risk and suitability factors that your advisor should discuss with you before you consider adding them to your portfolio.

Ask your advisor questions about whether the subordinated debt or preferred shares contain NVCC features and how this type of asset, before and after conversion, would fit within your portfolio.