If you’re curious about Canadians experiences with buying crypto assets, you’ll want to read the results of the OSC’s Crypto Assets 2023. It provides insights into the evolution of Canadians’ crypto ownership and knowledge.

On this page you’ll find

How interested are Canadians in crypto?

The OSC’s Crypto Assets 2023 reveals a profile of crypto owners, their reasons for purchasing crypto assets or funds and the role of financial advice. It compares the findings to the 2022 Crypto Assets Survey to understand how Canadians’ views of crypto changed.

Read the full report Crypto Assets 2023

Read the previous report 2022 Crypto Assets Survey

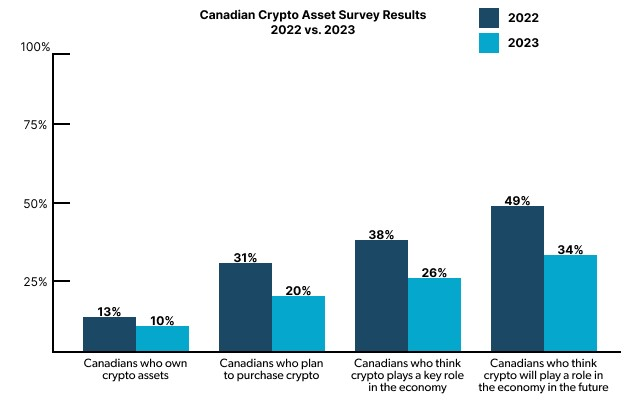

The OSC’s Crypto Assets 2023 found that the proportion of Canadians who own crypto dropped 23% compared to a similar survey in 2022. And more Canadians who own crypto regret investing in it.

Canadians are less interested in crypto investing compared to last year’s survey. And they are less likely to believe it plays a key role in the economy now or will play a role in the future.

Canadians reported their crypto asset investments are not doing as well as a year ago. Fewer owners held crypto asset portfolios worth more than they originally invested. And not surprisingly, more crypto asset owners expressed regret over purchasing crypto assets compared to a year ago (77% versus 68%).

Want to know more about crypto assets? Visit GetSmarterAboutCrypto.ca

How knowledgeable are investors about crypto?

Overall, Canadians know more about crypto than a year ago, and positive opinions of crypto have declined. Compared to 2022, more Canadians could identify a basic definition of crypto assets (2023: 54%, 2022: 51%).

Many Canadians have low confidence that if they bought crypto now, they would be able to sell it in the future. Only 16% of people in 2023 were highly confident in crypto assets and 15% in crypto investment funds.

Want to gauge your knowledge? Try our Crypto Quiz.

Why did Canadians purchase crypto?

The reasons provided for purchasing and not purchasing crypto were similar in both surveys. The most common reason given for buying crypto was as a speculative investment or gamble (28% both years).

However, fewer crypto owners reported buying crypto as a long-term investment in 2023 compared to 2022. (2023: 20%, 2022: 29%).

Among those who have never owned crypto assets or crypto funds, the top reason for not buying were:

- Concerns about potential risk.

- Lack of knowledge about crypto.

Know what’s behind your financial decision-making? Sometimes people invest in something just because a lot of other people are. Find our more about herd behaviour and how it might be influencing you.

What’s the profile of crypto owners?

The profile of crypto owners was mostly consistent year over year between the two crypto surveys. In both 2022 and 2023, compared to non-crypto owners, crypto owners were more likely to be:

- men

- aged 25-44

- employed full-time

- investors

- self-directed investors

And crypto owners were more likely to have:

- attained high education levels

- high financial knowledge

Crypto owners were more likely than non-owners to believe strongly that crypto plays a key role in the financial ecosystem and that it will play a key role in the future. Crypto owners were also more likely than non-owners to intend to buy crypto in the next 12 months.

Where did people learn about crypto?

Canadians who bought crypto received information from a variety of sources. And they seemed to be getting different advice than non-owners.

Canadians who bought crypto conducted research primarily based on information from:

- family, friends and colleagues

- social media influencers

- blockchain experts

- financial press

Among crypto owners, 80% reported seeing advertising for crypto or crypto trading platforms. And 65% said their financial advisors recommended they buy crypto investments in 2023 (which is higher than the survey in 53% in 2022).

Watch this video to learn what a finfluencer is and why you should think twice about taking their advice.

Did people check registration before investing?

Crypto owners vary in their behaviour around registration, trading, and storing crypto. Notably, the majority did not confirm, or do not recall confirming, the registration of a trading platform before purchasing crypto.

Only 38% of crypto owners reported they confirmed their trading platform was registered before purchasing crypto. While half did not check and 13% were not sure if they had checked.

Remember to always check before you invest.

What were the trading and storage results?

There were fewer crypto owners who reported trading crypto assets at a high frequency (six or more times a year) compared to 2022 (2023: 53%, 2022: 61%).

And more crypto owners in 2023 reported they had not made any trades within the past year (2023: 17%, 2022: 11%).

For storage, almost half of crypto owners said they stored their crypto on the platform where they bought it, while 32% used an online crypto wallet. And 4% of crypto owners did not know how or where their crypto is stored.

The online crypto asset survey included 2,360 Canadians aged 18 and over with an oversample of crypto owners to ensure a minimum of n=500. Fieldwork was conducted from May 16 to June 7, 2023.

Summary

The OSC’s Crypto Asset Survey 2023 found Canadians’ crypto ownership declined by 23% compared to a similar survey in 2022. And more Canadians regret investing in crypto.