View this page as a printable PDF.

November 28, 2019 – As more responsibility for investing shifts to individuals, it is essential that they have enough financial knowledge to effectively participate in Ontario’s capital markets. The OSC is actively involved in providing investor education resources to help investors achieve improved financial outcomes.

There are significant differences in the level of financial literacy among investors. The OSC Investor Office commissioned a survey of 2,000 Canadians to learn more about the different levels of financial knowledge and investor experiences in Canada.

Achieving progress in increasing financial literacy may be key to strengthening investor protection and experiences. Investors with a greater level of understanding of financial concepts are better able to make informed investment decisions and avoid fraud.

Knowledge of Financial Matters

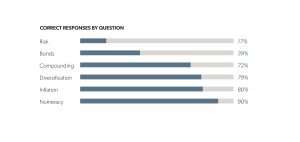

When asked to rate their overall knowledge of financial matters, 51% of respondents thought that they were about average. Their actual knowledge was then measured using a six question quiz. These questions covered risk, inflation, compounding, diversification, numeracy, and bond prices. This graph shows the percentage of respondents that answered each question correctly. The questions about bond prices and evaluating risk proved to be the most challenging for respondents.

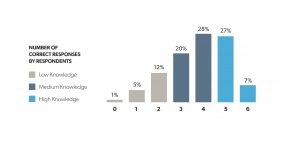

The results reveal that there are substantial differences in the level of financial literacy among Canadian investors. Only 18% of respondents had low knowledge and the majority answered half or more of the questions correctly. Only 7% of respondents were able to answer all six questions correctly.

Perceived Level of Financial Knowledge

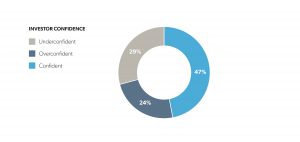

Comparing how respondents rated their financial knowledge to their test results revealed that many investors do not know how financially literate they are. 29% of investors may be underconfident because their level of financial literacy is actually higher than they think. This may cause individuals to be overly conservative in their investing. A more significant problem is that 24% of investors may be overconfident. They think they know more than they do. This may cause them to take unnecessary investing risks and make bad decisions with their money.

The Investor Experience

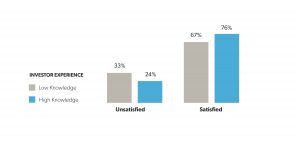

Financial literacy is an important part of the investor experience. 72% of the respondents were satisfied with their experiences investing in Canada.

The survey showed there is a relationship between investor satisfaction and their level of financial knowledge. Respondents with low financial knowledge (scoring less than 50% on the financial knowledge questions) were more likely to be unsatisfied with their experiences than those with high knowledge (scoring above 80%).

Improving the investor experience is a priority for the Investor Office and the OSC. This survey demonstrates that Canadians with high financial literacy are more satisfied with their experiences as investors. The OSC will use the data from this survey to develop new and innovative ways to deliver investor education and support retail investors in today’s complex investing environment.

About the Survey: The OSC Investor Office engaged Leger Marketing Inc. to conduct a survey to help us understand the level of financial literacy among Canadian investors and how this knowledge effects their experiences as investors. The survey was conducted online among a representative sample of 2,000 Canadians, 18 years of age or older, between October 29 and November 4, 2019. The sample has been weighted down to n=2,000 by age, gender and region using the latest Statistics Canada census data to reflect the actual demographic composition of the adult population 18 years of age or older residing in Canada. These preliminary findings are part of a broader research study that the OSC Investor Office will publish at a future date.