An OSC experiment looked at whether using gamification techniques to promote certain assets on investing platforms presents a risk to investors. Find out more.

On this page you’ll find

Why is gamification a concern?

Digital investing platforms are popular and make it easier for people to participate in financial markets. But certain gamification techniques used on some of these platforms can be concerning. Gamification techniques can influence your behaviour in several ways, and you probably won’t even realize. They can encourage you to trade more frequently than you otherwise would, which has been shown to lower investment returns in the long run. These techniques can also affect your trading decisions by nudging you toward certain investments that may not be suitable for you.

Would you be influenced to trade certain assets promoted by gamification techniques on a trading platform? The OSC conducted an experiment to find out.

Read the full report: Gamification Revisited: New Experimental Findings in Retail Investing

How was the experiment conducted and what did it find?

Experiment participants received $10,000 in virtual “money” to invest in fictitious stocks on a made-up trading platform. Participants could buy and sell six different stocks over the course of seven simulated weeks of trading. The researchers also tested the impact of four digital engagement practices which were shown to different participants:

- Social interactions: Participants saw a social feed which contained posts promoting certain stocks in the experiment.

- Social norms data: Participants were shown a table outlining how many other users bought or sold each stock for that week of trading.

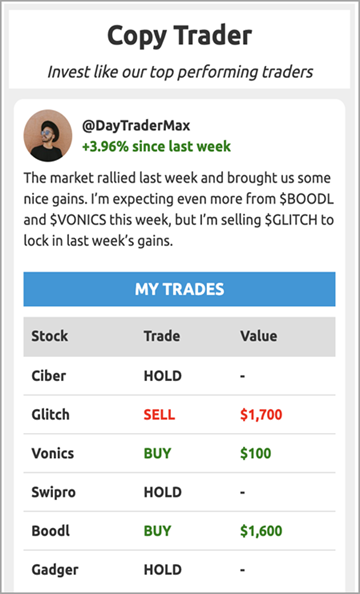

- Copy trading: Participants were given the opportunity to copy the trades of a “high performing” user on the platform.

- Leaderboards: Participants were shown a leaderboard displaying the ranked returns of users on the platform.

The main focus of the experiment was to see how much participants traded “promoted” stocks in the social interactions, social norms, and copy trading conditions. This was intended to measure the influence of non-expert, social information on the trading behaviour of Canadians. This type of information can be of limited value in terms of the investor’s outcomes. A secondary focus of the experiment was on how many trades participants made. This was to assess whether digital engagement practices increase trading frequency.

Two types of gamification techniques used in the experiment had a significant impact on participants’ trading behaviour:

- Social interactions: Participants who saw promoted stocks featured within posts on a social feed traded 12% more in those stocks.

- Copy trading: Participants who had the option to copy the trades of a “high performing” user traded 18% more in the promoted stocks.

These findings suggest that these forms of gamification techniques that provide irrelevant information or information of limited value to an investor can influence investor behaviour by encouraging people to trade specific assets. This influence is likely to have a negative impact on investors, potentially through excessive risk taking or assembling a portfolio that is not properly diversified.

Gamification Revisited: New Experimental Findings in Retail Investing builds on the OSC’s existing research report from 2022: Digital Engagement Practices in Retail Investing: Gamification and Other Behavioural Techniques.

The 2022 report includes the results of a similar experiment showing the impact of “points” and “top-traded lists” (two other gamification techniques) on trading frequency and trading of specific stocks. The experiment found participants rewarded with points with negligible value for buying and selling stocks made 39% more trades. This is important because more frequent trading generally has a negative impact on investor returns. And participants who saw a list of top traded stocks were 14% more likely to buy and sell those stocks. Collectively the two research studies show that the use of gamification techniques alone can have a direct impact on investor behaviour, in a way that may be against investors’ best interests.

GetSmarterAboutTrading.ca exposes you to gamification techniques that can influence your investing behaviour — often in ways that are not in your best interest. It gives you a chance to participate in a simulated stock market and practice online trading — without risking real money.

Why is studying gamification important?

The OSC’s research into gamification shows the value of using behavioural science research to assess investor risks and contribute to securities regulation.

The OSC’s gamification research reports also contain several recommendations for how regulators and authorities in Canada and abroad might respond to the ongoing use of digital engagement practices by online investing platforms. This could include considering updates to regulations for digital trading platforms and potentially limiting problematic digital engagement practices that research shows can harm investors.

Many investing platforms are using new marketing, engagement, and design techniques to influence your behaviour as an investor. The use of these techniques has generated global regulatory concerns due their negative impact on your financial wellbeing as an investor, as well as privacy risks. The OSC research report, Digital Engagement Practices: Dark Patterns in Retail Investing, looked at how these techniques are being used by investing platforms and how regulators in Canada, the U.S., and the EU are responding.