Read the research summaries on retirement preparedness, conversations about aging and finances, and cannabis investing.

Read the full study results.

November 28, 2018

A new study by the Ontario Securities Commission (OSC) Investor Office found that Canadians aged 18-34 are the most likely to believe their standard of living will increase in retirement, despite being the least likely to have started saving for retirement of any age group.

The study, published as part of the OSC’s activities for Financial Literacy Month, covered several topics, including:

Retirement preparedness

Younger Canadians are most likely to be optimistic about retirement, but least likely to have started saving for retirement.

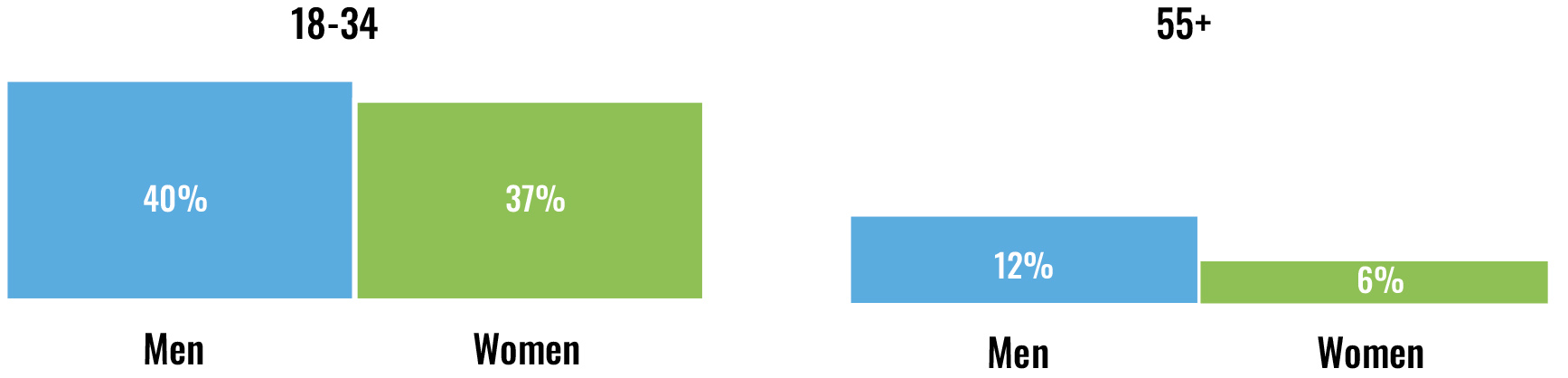

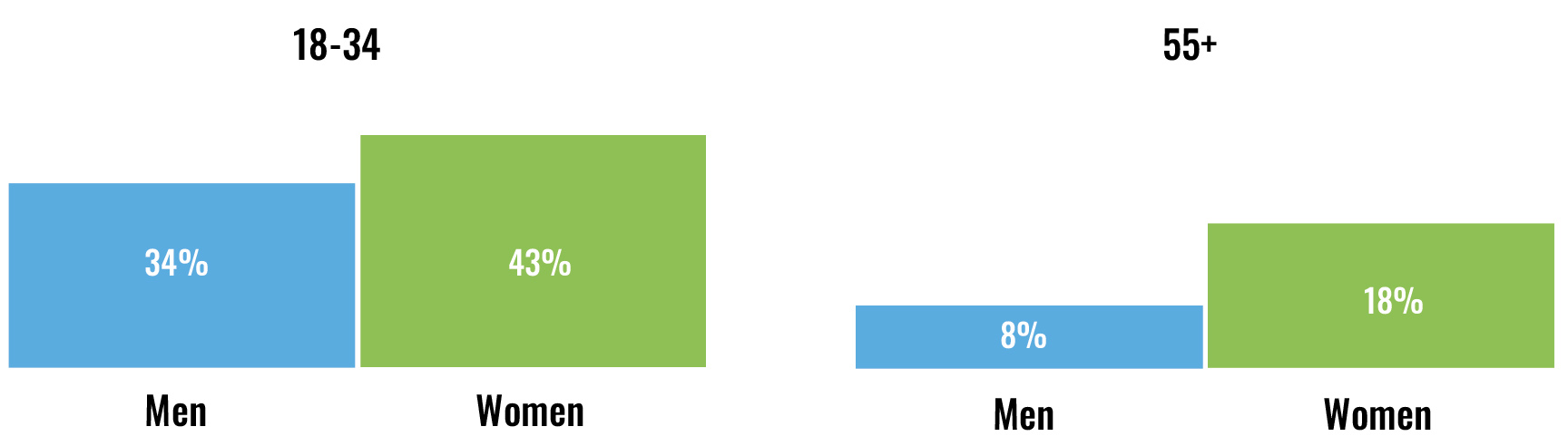

Percentage of pre-retirees who expect their standard of living will be better in retirement than it is now

Percentage who haven’t started saving for retirement

Conversations about aging and finances

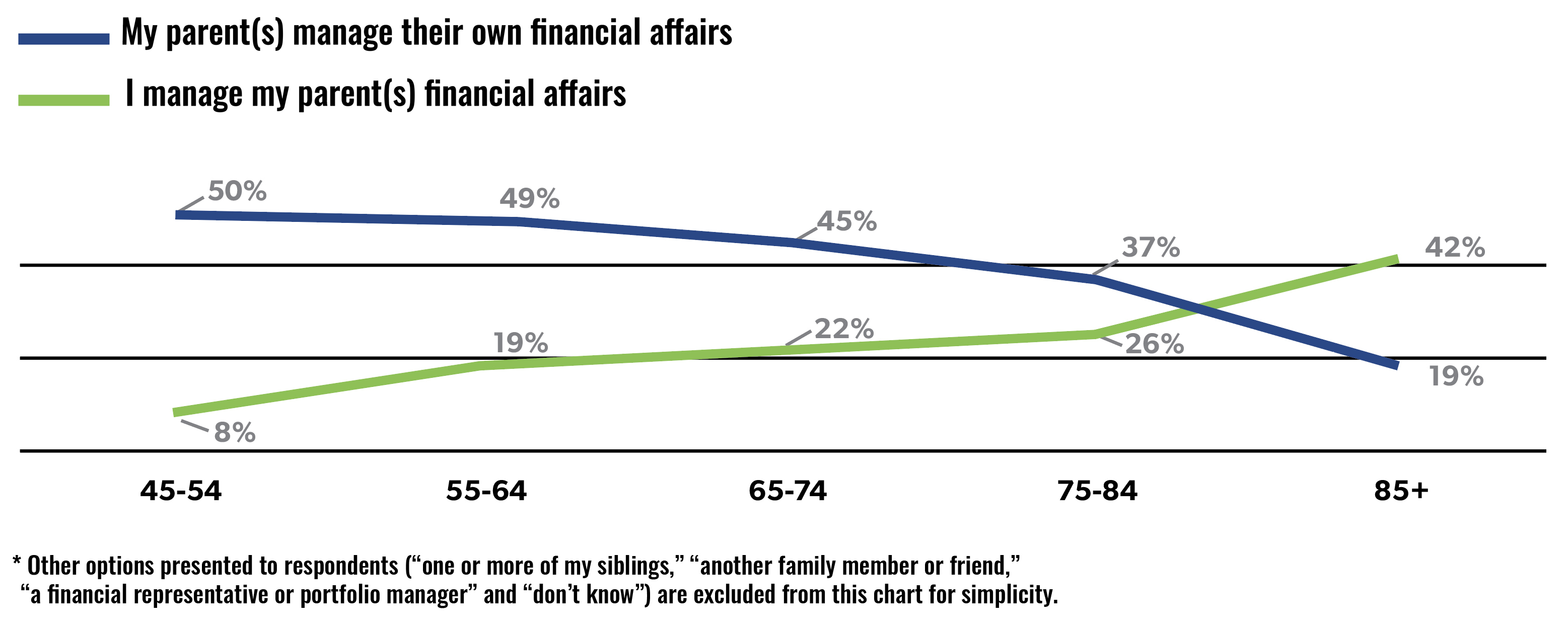

Most Canadian adults with parents aged 45 or older say their parents have not talked to them about how they would like their finances managed if they were no longer able to do so. However, over 4 in 10 (42 per cent) Canadian adults with parents aged 85 or older reported that they are responsible for managing their parents’ financial affairs.

Cannabis investing

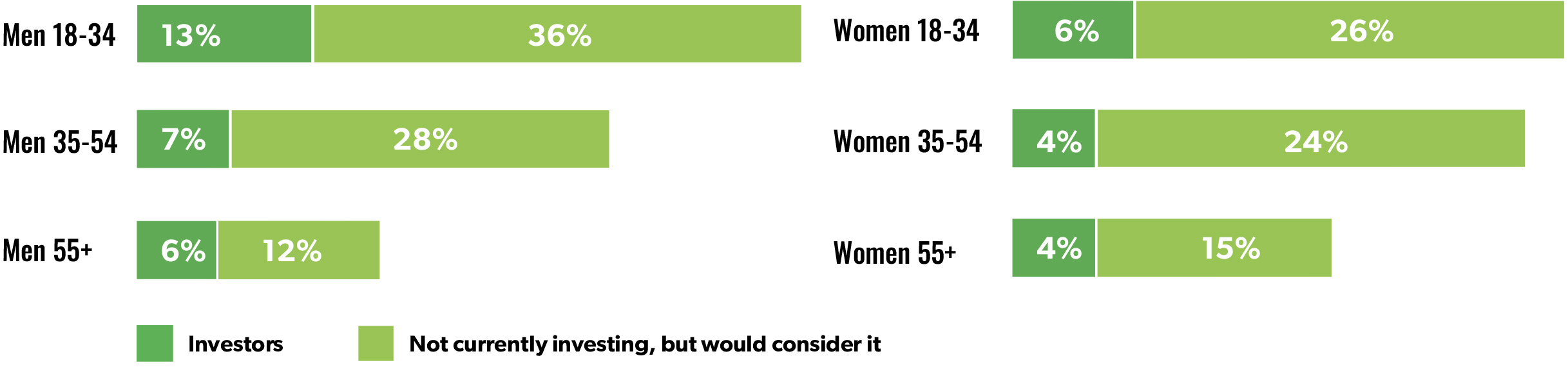

Seven per cent of Canadian adults currently own cannabis investments, and 1 in 4 cannabis investors reported spending $10,000 or more on their investments.

Amount cannabis investors spent purchasing their investments

Cannabis investing rates did not vary based on financial knowledge or reported risk tolerance.

Men aged 18-34 were more likely than any other demographic group to own cannabis investments.

Read the research summaries on retirement preparedness, conversations about aging and finances, and cannabis investing.

Read the full study results.

About the research: The OSC’s research was conducted by Innovative Research Group and involved an online survey of 2,259 Canadians, aged 18 and older, between October 11 and 22, 2018. The results were weighted by age, gender and region using the latest Statistics Canada Census data to reflect the actual demographic composition of the adult population aged 18 and older residing in Canada.