Online investing has made it easier than ever to buy and sell stocks, ETFs, and commodities, all from your phone or computer. These platforms offer convenience and personal control for the investor. But their design can quietly shape your decisions in ways you might not notice, through a variety of digital engagement practices.

On this page you’ll find

What are digital engagement practices?

Digital engagement practices (DEPs) are design features or techniques that encourage you to interact with an app or website more frequently or in a certain way. A recent review by the Ontario Securities Commission found many online retail platforms use these practices. DEPs can be helpful in some cases, but they also often nudge you toward behaviours that can be detrimental to your financial goals.

Common examples include:

- Push notifications that prompt or encourage you to take specific actions.

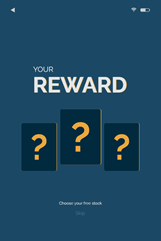

- Badges or rewards tied to increased trading activity.

- Contests with gambling elements.

- The use of hidden information and complex language that obscures important information.

- Games and game-like elements designed to keep you on the app for longer or encourage more frequent trading.

- Top traded lists to draw attention to specific assets.

While some of these features can make your experience on the app more interactive, they can also influence your decision-making.

Example of rewards, where users are awarded points for completing various in-app actions, such as referring to a friend or making a trade.

How can digital engagement practices influence your behaviour?

Digital engagement practices can affect how you think, feel, and act when engaging with online investing platforms. For example, the OSC found that rewarding trades with points led investors to trade more often, and highlighting particular assets can lead to increased trading of those assets. Research has shown that trading more generally leads to poorer returns in the long run. Certain uses of DEPs are concerning, as they can expose investors to additional risks and fees that they might otherwise avoid.

There are a few reasons why DEPs can be concerning:

- You may trade more often than planned: Notifications, “trending” alerts, in-app prizes/incentives, and leaderboards can lead you to act quickly and impulsively — sometimes before thinking through your decision. The more you trade, the more likely you are to make suboptimal decisions and pay extra in fees. There is robust evidence that links increased trading volume with lower returns over time. This is due to both the timing of retail investor trades relative to other traders (e.g., institutional), as well as transaction costs (e.g., commissions, trading fees). Retail investors often trade at suboptimal times — they often buy stocks after prices have already gone up (chasing trends) and sell after prices have fallen (panic selling). In other words, they tend to “buy high and sell low,” which usually leads to worse returns than just holding or investing passively.

- You may take on more risk: Some practices highlight higher-risk or complex products in a way that makes them appear more appealing or less risky. Always take time to understand what you are investing in and that it fits with your risk tolerance and risk capacity.

- You may react impulsively: When a platform makes trading as easy as a single swipe, you might act without pausing to consider whether the trade aligns with your long-term investment plan.

- There may be hidden incentives: Some firms benefit when clients trade more frequently or buy certain products. Be mindful that what appears as a friendly nudge could also serve the platform’s business, and may not be in your best interest.

- It can distract you from your long-term goals: Constant alerts and updates can shift your focus to short-term trading, and from many activities — including focusing on steady, long-term investing and other healthy financial activities such as budgeting.

Read more about OSC research including: Gaming the system: Are you being influenced when trading online?. Shedding light on dark patterns and Digital Engagement Practices in Retail Investing: Gamification and Other Behavioural Techniques.

Can digital engagement practices be helpful?

Not all digital engagement is bad. Some platforms also use DEPs in positive ways — to educate, inform, or help you stay on track with your goals.

Helpful practices may include:

- Goal tracking tools that encourage regular saving and long-term planning.

- Security alerts that encourage you to take steps to protect your account.

- Educational tools that elevate your investment knowledge.

When used responsibly and thoughtfully, these features can improve financial literacy, support good investing habits, and promote account security.

How do you stay in control when facing digital engagement practices?

Your investing decisions should always serve your financial goals, not the platform’s engagement metrics. There are practical steps you can follow to keep your investing decisions aligned with your long-term goals when encountering behavioural nudges. It’s a good idea to:

1. Start with a clear plan

Define your goals, time horizon, and risk tolerance before using any platform. Having a plan helps you stay grounded, even when digital “nudges” tempt you to stray from your objectives.

2. Control your notification settings

You can customize your notification settings in the app to choose what you receive and how often. This way, you only see the notifications that matter to you — putting you in control of how you engage with the app.

3. Pause before reacting

If you receive a notification urging you to act, stop and ask: Is this aligned with my goals or is the app encouraging me to trade? Don’t let your emotions sway you into making impulsive decisions. Consider whether you can turn off notifications that nudge you to trade or change your notification settings to allow any specific information you wish to be notified on. Just as you might take a cooling‑off period before buying something online, consider delaying any action to give yourself time to reflect.

4. Watch for behavioural patterns

Are you trading more often since using the app? Are you checking your portfolio daily? Awareness helps you identify when engagement features are steering your behaviour.

5. Review fees and costs

Frequent trading can add up in commissions, spreads, or unintended tax implications. Even “commission-free” trades may have indirect costs. Make sure you understand what fees and costs your platform charges — and pay attention to them, because these costs can reduce your net returns, especially over the long term.

6. Protect your data

Check how your platform uses behavioural data — information about your activity such as pages visited, clicks, or cookies — and if you can manage how that data is used. Some collect information on your activity to tailor offers or promote specific products.

7. Focus on the long term

Remember, investing success isn’t about frequent trading activity — it is about time in the market, not timing the market.

Firms are required to act fairly, honestly, and in good faith with their clients, and to address material conflicts of interest in the client’s best interest. If you ever have concerns about how a firm engages with you, reach out to the firm. Find out more about how to make a complaint.

GetSmarterAboutTrading.ca exposes you to gamification techniques that can influence your investing behaviour — often in ways that are not in your best interest. It gives you a chance to participate in a simulated stock market and practice online trading — without risking real money.

Summary

Digital engagement practices are part of nearly every online investing experience today. They can make platforms easier and more enjoyable to use — but they can also influence your decisions in subtle ways. By staying aware of how these features work, and by grounding your actions in a solid investment plan, you can reduce the influence of digital engagement practices on your decisions.